FIRE over 50: Part II: The 4% rule & inflation

May 23, 2022

Let’s jump right back into the FIRE movement, or the Financial Independence and Retire Early movement.

Last time, we talked about what sparked FIRE and described some of its tenets, as well as how they applied to those of us greyer in years. (Click here to read FIRE over 50 Part I.)

One of those tenants that we did not talk about…one that is common among all retirement communities is how much savings you should have set aside? And how much you can safely withdraw?

FIRE takes a simplified approach to this question…and they use the inverse of the 4% rule.

Quite simply they say the goal is to have 25 times your annual income saved. Once you hit that goal, you should be able to withdraw 4% a year, without issue.

They base this number on long-obsolete studies about asset allocations, expected returns and safe withdrawal rates.

As a rule of thumb, having 25 or 30 times your annual needs saved, is a good indication that one has enough to retire.

I am not going to address the question, is a 4% withdrawal rate a good number…or if it is safe…or if it is even something you should assume. We will leave that discussion for another time.

The 4% Rule and Inflation

For now, I want to address the elephant in the room. The thought on all our minds how does FIRE, and the 4% rule, deal with inflation? And does persistently high inflation impact how much you can take in retirement.

Here is the short answer; in my opinion, If you have amassed a financial portfolio that meets the rule of thumb, as set forth by the FIRE movement—25x your annual spending—then you should be fine.

The market has historically returned about 6 to 7%, per year, post-inflation.

Stocks, as risky and volatile as they feel sometimes, are among the best inflation hedges.

As long as you stick to the other tenants of the FIRE movement, specifically only investing in equities and having a cash cushion – then you should be fine.

The 5-Year Cash Rule

However, as retirees, and soon to be retirees, another risk we must always be cognizant of? Bear markets. A bear market is when the market drops below 20% from a recent high.

For short term volatile, and the “usual” market corrections that happen every few years, the FIRE movement proscribes having 5 years' worth of “safe money” in cash.

In theory, this is great.

This allows you to keep your money invested during periods of volatility and sidestep that “sequence” of return risk that we discussed in previous blogs (FIRE Part I, Sequence Risk, 8-Ways to Reduce Market Volatility, and our “How to Survive and Thrive in a Down Market” Guide.)

During these early years, even moderate market drops, when combined with withdrawals, can cause unrecoverable losses to one’s retirement portfolio.

Of course, the real danger is a secular bear market.

A Secular Bear Market Means Old Ways Will Not Work

For those who are within 5 years of retirement, or are in the early years of retirement, a secular bear market can spell devastation for their retirement plans – and no amount of “cash” savings will help.

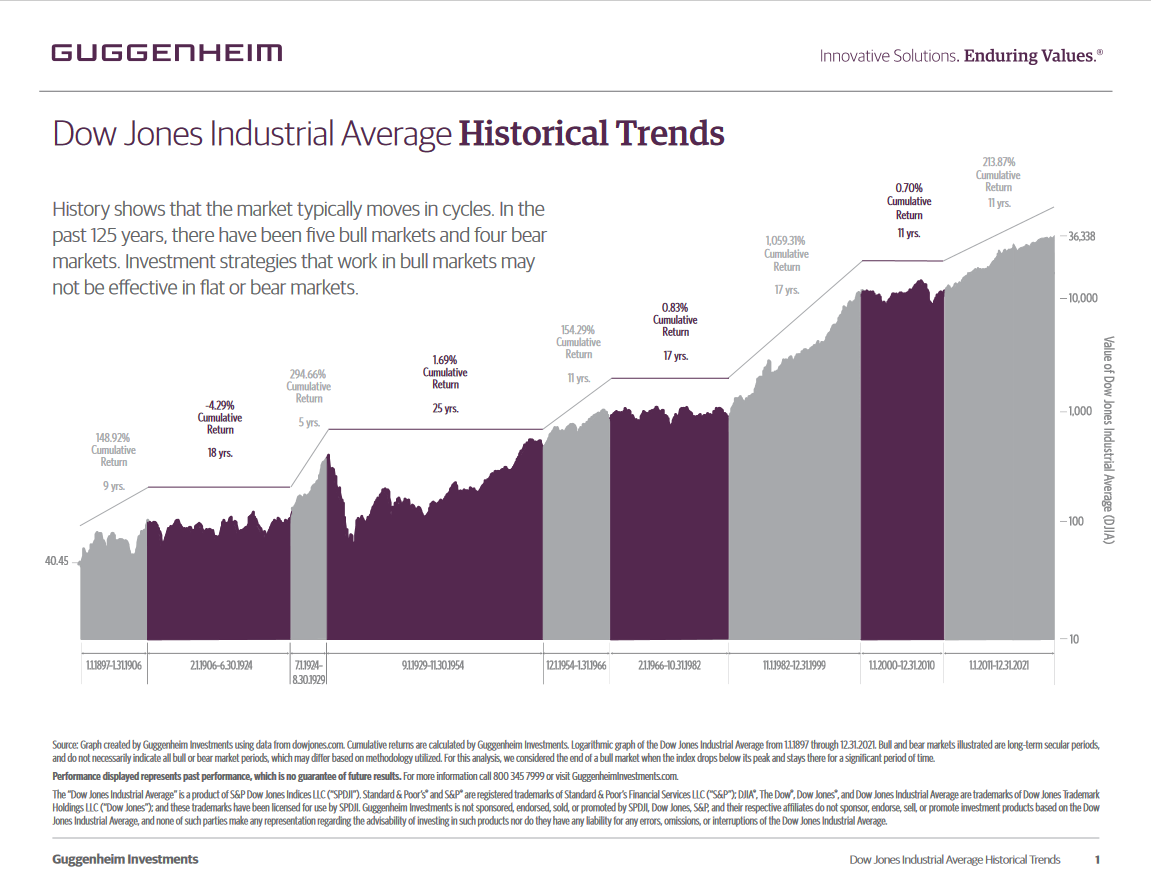

A secular bear market is when market returns are below average for years at a time. Over the last 125 years, there have been 5, secular bull and bear markets. (See chart below)

The good news is that secular bear markets present great opportunities – just NOT for the buy and hold investor. For the buy and hold investor, they will be lucky just to beat inflation.

As an investor who relies on your portfolio for income, you may want to consider shifting more money into bonds, dividend stocks, and even uncorrelated international markets. Often, if the U.S. is performing poorly, these asset classes might provide some ballast to your portfolio. Rarely is a bear market truly global—there are always opportunities and growth in other parts of the market or the world. (Here’s an example of one AI based strategy that works well in this type of market.)

Another upside to bear markets: you can perform ROTH conversions.

After all, a key piece of the FIRE movement is to get as much money into ROTH accounts (aka “income tax paid” accounts) as possible. With ROTH conversions, you move pre-tax traditional 401(k) and IRA money into after-tax ROTH accounts at relatively low market values during bear markets.

When done properly, you can then capture the inevitable stock market recovery in an income-tax-free way! Think of bear markets as a massive tax break for those on their way to FIRE (though market declines might feel like a delay on your journey to retirement).

For more information on how to execute this check out my guides:

To your success,

Leibel

Have Questions? Get the answers you need.