New IRS Rules For Your Retirement Accounts

May 02, 2022

As an avid Leibel on FIRE reader, I am sure you’ve picked up on the fact that I LOVE taxes. Or more specifically, I love minimizing taxes for retirees.

In fact, I believe that unnecessary taxation and market losses are the two greatest threats to today's retirees.

I also believe that the tax-code is like a treasure map to wealth. When read properly, it tells you what to do, how to do it, where and how to own your assets, and even when to buy and sell.

And like any good government run program, it is ever changing.

Which means that your financial plan needs to be constantly changing.

What worked yesterday, probably will NOT work tomorrow.

Here is a perfect example of what I mean.

Recently the IRS tweaked the contribution limits for accounts like your 401(k) and Roth IRA. This means that you can save more for retirement tax-free (yay!)

This adjustment is something the IRS does every few years, as a result of the Tax Cut and Jobs Act, which is set to expire in 2026…at which point everything we’ve been doing will change again.

In addition to contribution rates, the IRS also updated withdrawal rules.

Here’s the highlights; you can now sock away an extra $500/year in your 401k/IRA account.

Individuals on the higher-end of the income scale should also know about 401(k) plan limits. For 2022, a worker can defer up to $20,500. Those 50 and older can contribute an extra $6,500 as a “catch-up.” Keep in mind that your total retirement contribution limit is $61,000; $67,500 for the 50+ crowd. That includes your plan contributions and matches from your employer.

More changes could be on the horizon for our beloved “backdoor” Roth IRA.

The backdoor Roth is a legal loophole in which high-income taxpayers make non-deductible contributions to a traditional IRA/401k and then immediately convert that money into a Roth IRA.

The strategy makes sense because they do not qualify for regular Roth IRA contributions as their income is above the limit established by the IRS (there is no such income limit on non-deductible Traditional IRA contributions).

For 2022, joint filers cannot put money directly into a Roth IRA if their modified adjusted gross income is above $214,000 (single filers: $144,000).

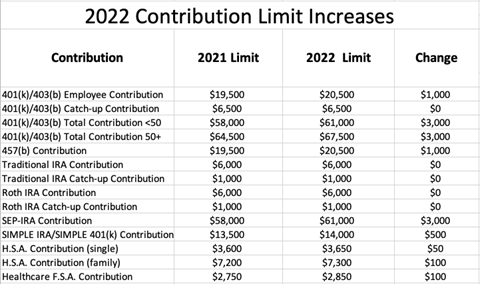

Here are the NEW contribution limits for the various retirement accounts.

2022 Plan Contribution Limits

Source: The White Coat Investor, IRS data

As a refresher, “Roth” money is our “tax me when I choose” account. It is money that we choose when to pay taxes (ie. when we contribute/convert) and then the funds are tax-free in retirement. (of course these are subject to early distribution penalties.)

Time might be ticking on your ability to perform a backdoor Roth IRA strategy. While it is still a legitimate move, the Build Back Better bill could nix it before long. This piece of legislation passed the House of Representatives last year but has not yet made it through the Senate. How soon will the proposal go into effect? It’s hard to know, but high-income tax filers should be sure to complete their backdoor Roth moves sooner rather than later.

My bet is that some form of the restriction will eventually pass, Congress doesn’t really have a choice – they need the tax revenue.

In addition to contribution rules, the broader rules around required minimum distributions (RMDs) were inked into law recently since people are living longer. Critics also say that the government wants to get their tax dollars from you earlier, as evidenced by new withdrawal rules for inherited IRAs. That makes careful financial planning even more valuable. We’ve discussed this on previous blogs and podcast episodes.)

Managing taxes is a key piece of your retirement plan. At Yields4U, we are always in tune with the latest noise our lawmakers are making on Capitol Hill. While some changes make immediate headlines, others are buried in bills, and it’s our job to know about them so that you are not caught by surprise.

Don’t forget to subscribe to our blog, podcast, tiktok, or facebook pages to get the latest updates.

And check out our guide “How to pay zero in taxes in retirement.”, CLICK HERE to download it.

Have Questions? Get the answers you need.