Roth Conversions: Windfall for some, Bust for Others…Investors Should Proceed with Caution

Nov 15, 2022

As we near the end of the year, taxes should be on your mind…and drops in the stock and bond markets often present great opportunities.

One particular strategy capitalizes on this year’s market antics: the Roth Conversion.

A Roth Conversion is a straightforward process whereby an investor shifts assets from a pre-tax account, like a Traditional IRA or Regular 401(k) plan, into a Roth account (a Roth IRA or Roth 401(k)). This allows you to lock in today’s low tax rates…and avoid paying (potentially higher) taxes down the road.

As any of my faithful readers know, a down market is the perfect time to do Roth conversion!

You see, when markets are down, you essentially get to lock in a bigger tax savings. First you get to lock in today’s historically low tax rates, second you get to take advantage of the “lower” value of your beaten up stocks. This in effect lowers your tax bill. A double whammy.

Think of it this way:

Let’s say you have $50,000 of Traditional IRA money that dropped to $40,000. When the market recovers, that account will hopefully grow, let’s say to $100,000 or more – all of which would be taxable upon withdrawal.

Now let’s assume you did a Roth conversion near the market low and paid a 22% tax on that $40,000 amount this year. That is $8,800 of extra tax to pay in 2022 (less you if you do some tax-loss harvesting first.) Now, taxes never feels good, but consider that if you wait to withdraw your money later from a pre-tax account (not having done the Roth conversion) not only will you have a bigger tax bill as a result of a larger distribution, but future tax rates might be higher.

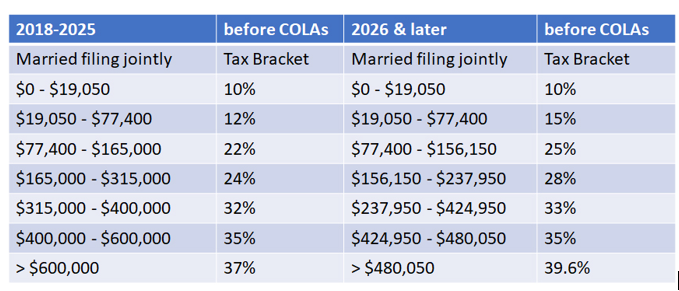

If nothing changes, marginal tax brackets revert their old, higher levels in 2026, when the Tax Cuts & Jobs Act expires. So, in our example, a $100,000 withdrawal in 2026 would possibly cost you $25,000 in taxes.

Marginal Income Tax Rates Set to Rise in 2026

Source: Retirement Insight

Now could be an ideal time to take advantage of a Roth conversion. There are strategic ways to go about it, though.

Here are some rules to keep in mind:

#1 – Always do “in-kind” conversions

An in-kind conversion is when you convert the actual securities (stocks, bonds, and mutual funds) rather than the more traditional “cash” conversions. This ensures that you don’t miss out on the market’s recovery.

With the markets dropping this year, it is risky to sell a fund and wait to buy back in since the markets could snap back quickly – before you have a chance to repurchase in a Roth account. Maintaining market exposure through the conversion process is important.

An in-kind conversion is also a double win. Not only do you save on taxes, as outlined earlier, but you also might pay less for the conversion since you are not trading out of and into new products which could have transaction fees.

For more information about this check out my guide on Roth Conversions, called “How to Ethically Pay Zero in Taxes in Retirement.” I also have several blogs and podcast episodes dedicated to this topic. If you would like help, click here to book an appointment.

#2 – Proceed with Caution

While a Roth conversion might seem like the eighth wonder of the world, all folks should tread carefully. You must assess your marginal tax rate today versus your effective tax rate in the future. If the former is lower than the latter rate, then a Roth conversion makes sense.

During the early years of retirement, our taxable income aka our tax rates are usually at their lowest points – this is usually the best time to do Roth Conversions. Moreover, if the SECURE Act 2.0 gets passed, retirees will have more time to perform strategic Roth conversions before Congress mandates you perform your Required Minimum Distributions.

So, I urge all retirees to take caution and not rush into Roth conversions.

Do the math.

Make sure it will likely save you money. The thing is, there are many salespeople (who claim to be advisors) pitching a “convert all” strategy so they can get their hands on your 401(k) assets. Seriously eroding your retirement savings up front is rarely a good idea…because of something called “sequence risk.”

Sequence Risk

“Sequence of returns” risk is very real right now. It is the risk of accelerating market losses, by withdrawing money during periods of market volatility. Remember, in retirement, all losses are equal. The last thing you want to do is compound market losses with an ill-timed tax bill... all for “potential” tax savings. If someone recommends a full conversion, double-check the math with an experienced advisor or tax professional.

At Yields4U, we work in the best interest of our clients. We are fiduciaries and tax professionals. While Roth conversions can make sense, they must be done only after careful consideration and due diligence. If you would like us to help you assess if a Roth conversion is right for you, click here to book an appointment today.

Have Questions? Get the answers you need.