S&P 500 is officially down for the year, recession or correction?

Feb 27, 2020

The latest news from China and Trump's comments have the market riled. The S&P 500 dropped for the second day this week, wiping out the markets gains for the year. Here are the critical facts you need to know.

#1 - Why are markets so volatile?

Disease outbreaks are hard to predict and come with a great deal of uncertainty that can make investors nervous—particularly after a period of record market gains.

As the epidemic spreads beyond China, investors worry that it could cause serious disruptions to trade and the interconnected global economy.

#2 - How long will the volatility last?

It’s hard to say. Though the human cost of an outbreak like Coronavirus is tragic, it’s unclear how widespread the economic fallout will actually be. We can’t predict what markets will do, but this isn’t the first time we’ve grappled with market reactions to an epidemic.

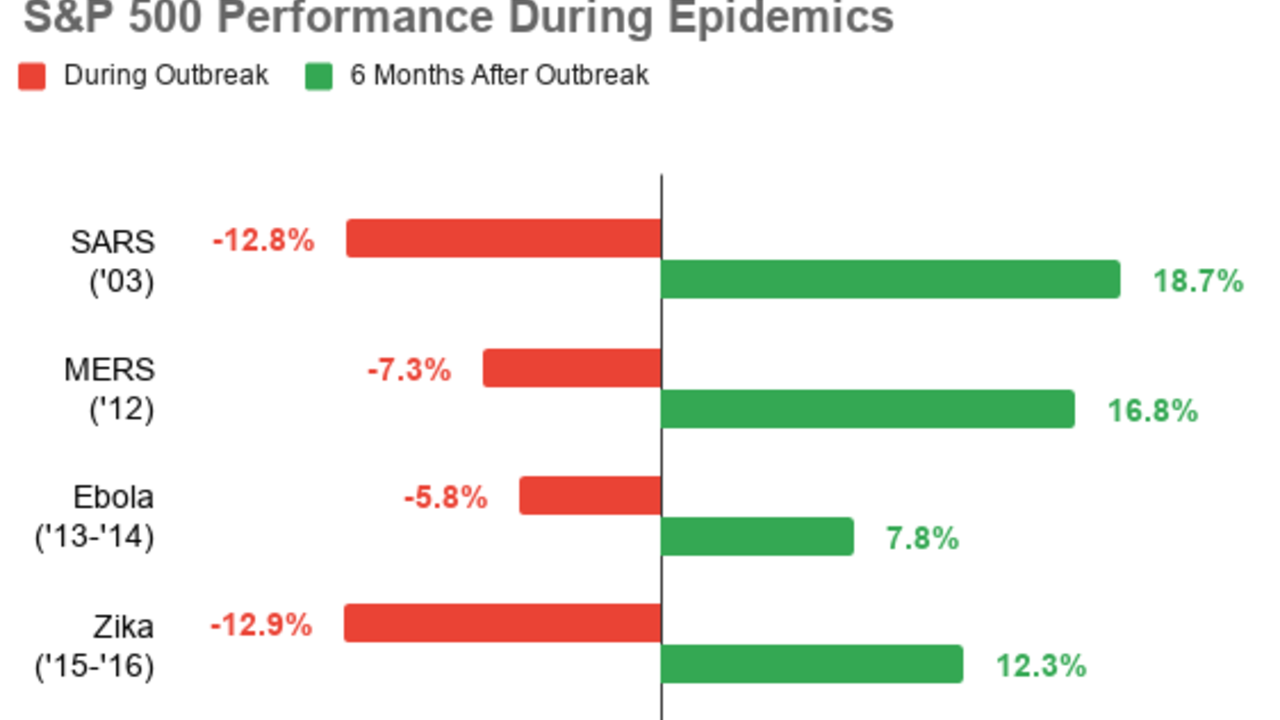

Here are some examples from previous outbreaks:

Chart source: CNBC, Yahoo Finance

Though the past can’t predict the future, we can see that historically, markets reacted to epidemics with panic selling, but recovered after the initial outbreak.

However, epidemics don’t happen in isolation; the underlying economic and market fundamentals will influence how investors react long-term.

#3 - Pullbacks and periods of volatility happen regularly, for many reasons, do you know your exit strategy?

Whether the cause is an epidemic, geopolitical crisis, natural disaster, or financial issue, markets often react negatively to bad news and then recover.

Sometimes, the push-and-pull can go on for weeks and months, which can be stressful, even when it’s a normal part of the market cycle. What I can tell you is that we are 11 years in to an artificial bull market, we are about to enter in to a highly emotional election, and investors are uncertain. Heck, even the Fed and central reserve banks around the world are uncertain. The big question on everyone's mind, will this be the catalyst that triggers the end of our current market cycle or just another blip on the radar?

The best thing you can do is make sure you have a sound exit strategy and avoid emotional decision-making.

Why?

Because emotional reactions don’t lead to smart investing decisions. The biggest mistake investors can make right now is to overreact instead of sticking to their exit strategies.

Do you have an exit strategy or are you using the "hold & prayer" approach to investing?

If you have any questions, or if you would like help implementing a sound exit strategy in your portfolio, just let me know.

Have Questions? Get the answers you need.