When Is the Right Time to Begin Planning Your Retirement?

Jul 25, 2022

After my dad died of prostate cancer at 63, I of course went to a urologist to assess my risks and discover what if any proactive measures I should take.

The urologist gave me a funny answer. One that I think applies equally well to retirement. He said, that I should start getting testing about 10-years prior to when my dad would have developed cancer. He said, testing any earlier and we wouldn’t know what that data meant.

When it comes to retirement, when is the best time to being planning?

It is easy to say, when your 20, or 30.

Or jump to easy conclusions like “today.”

But the truth is that, aside from “saving as early and often as possible.” The tougher question is when do we actually begin the process of “Retirement planning.”

…and I’m talking about specific actions like researching, taking courses on retirement planning strategies and talking with advisors. Based on my experience, the right answer, is about five to ten years out from calling it quits from your nine-to-five job.

Why that timeframe?

Simple. It’s because of this pesky thing called “sequence of returns” risk.

That phrase might sound like jargon to you, so let me detail what that type of retirement risk is and why it is critical that you plan for it.

The sequence of returns risk is the notion that the market could turn south just prior or in your early years of retirement. Think of it like this – your paycheck ceases and perhaps you have not yet started taking Social Security. There is a perilous gap. Even if you have a diversified, low-cost portfolio of stock and bond funds, if both areas of the market drop, then you might be in a world of hurt financially. By the way – both stocks and bonds falling at the same time – does that ring a bell? 2022 has been quite a year so far. (click here for a free guide on how to protect yourself from Sequence Risk)

Ensuring that your portfolio and cash flow situations are not caught flat-footed is imperative.

Just a few bad years at the onset of your retirement can cause plans to go awry. It is also why I do what I do. I want to see individuals, couples, and families reach their financial dreams and live with peace of mind.

When we plan in advance, there are tools we can use to bridge the gap between ending work and when you begin taking Social Security.

It’s often prudent to delay taking Social Security until age 70, particularly for a healthy married couple, since benefits increase 8% each year you push it out. (But due to the "Deemed Filing" rule this might not be true for everyone! Check out this free guide for more info.)

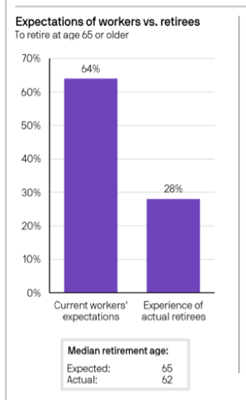

Moreover, the Employee Benefit Research Institute finds that the actual average retirement age is 62.[i] That means there’s potentially an eight-year window that must be planned for carefully. It also implies most people must start planning for retirement around age 57. (P.S. This is also an 8-year window where we can maximize aggressively reduce our future tax liability at rock bottom rates!)

Expectations vs Reality: The Average Retirement Age is 62

Source: J.P. Morgan Asset Management

Here’s something else to consider: You might be able to retire sooner than you think.

You don’t want to miss out on the most active years of your retirement.

People often find the first handful of retirement years as the “go-go” period when people are more likely to be healthy and active. That’s the time to embark on adventurous trips around the world and to vacation with friends and family. When you are in active planning mode, before retirement commences, you will spot opportunities such as scooping up a dream retirement home if the real estate market dips.

At Yields4U, it is our goal is to help to get people in a good financial spot before they retire. Many people end up retiring earlier than anticipated for a variety of reasons, some good, like having more money than they expected, and some bad, like encountering a health problem or disability. Ensuring reliable cash flow after working ends is necessary. For that reason, I strongly suggest pre-retirees begin actively planning their retirement with an advisor five years before stopping work. A failure to plan is planning to fail!

To get started on your retirement journey, check out our free class “The Simple Path to a Golden Retirement.” In this class you will find everything you need in order to start planning for a long, happy, and healthy retirement.

[i] https://www.ebri.org/docs/default-source/rcs/2021-rcs/2021-rcs-summary-report.pdf

Have Questions? Get the answers you need.